Sustainable development is a key focus for the Greater Bay Area, and Hong Kong is well positioned to leverage its unique advantages and become a prominent sustainable finance hub for the GBA, Asia and beyond, to support businesses in their transition.

With Hong Kong's Climate Action Plan 2050 underway, HSBC understands our customers have evolving needs to unlock transition and sustainability-linked growth opportunities with the help of our resources, tools, relationships and solutions. We're mobilising finance, investment and accelerating innovation to make this happen, working in partnership with our customers and those developing innovate climate solutions.

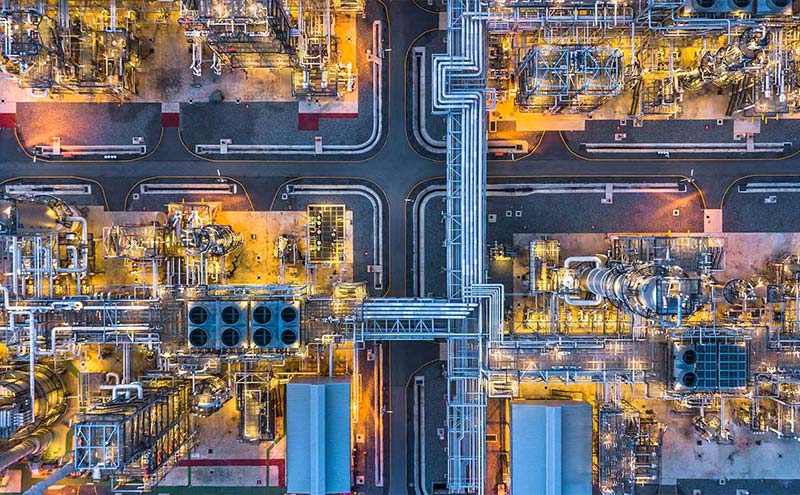

Today, we finance a number of industries that significantly contribute to greenhouse gas emissions and we have a strategy to help our customers to reduce their emissions and to reduce our own. We're focused on supporting businesses across the ecosystem and helping to deliver a net zero global economy, leveraging our global scale, deep expertise and strong presence across the region.