- Article

- Macro Outlook

- Market economies

Belt and Road Initiative

Forging a new path

- As it enters its second decade, the Belt and Road Initiative (BRI) is front and centre to mainland China’s opening-up strategy

- Mainland China’s lead in green tech has injected new life into the BRI; the global energy transition presents big opportunities

- The BRI’s new direction strengthens Hong Kong’s role as a green finance hub and an offshore RMB centre

The Belt and Road Initiative is accelerating and changing

Mainland China’s emergence as a major global investor is well recognised. In 2024, its total outbound direct investment (ODI) reached USD163bn, the fourth largest source of foreign direct investment in the world. Despite this, mainland China’s ODI flows are still small relative to the size of its economy, but we think they are set to accelerate. Tariff uncertainties could be a catalyst, with production moving closer to end-consumers. Domestically, “involutionary” competition has also incentivised more manufacturers to expand their footprint overseas.

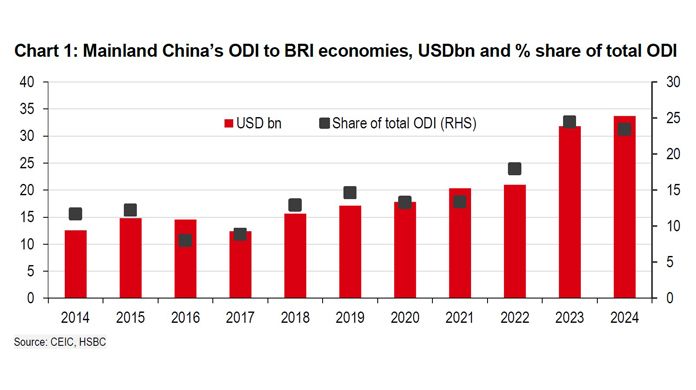

A growing feature of mainland China’s ODI is that a rising share of investments are destined for BRI participating economies. The share of total mainland Chinese investments going to the BRI has risen steadily to 25% in the first six months of 2025, up from the average of 16% in 2021 and 2022. During the same period, the number of BRI participating economies also grew by 12 to 150 (out of a total of 195 nations in the world), representing over 70% of the world’s population. This reflects the significance of the BRI in mainland China’s growing investment network.

As the BRI enters its second decade, it will continue to be an important vehicle for mainland China’s overseas investment. However, it has also undergone a significant strategic evolution, transforming from a broad infrastructure-focused programme into a sophisticated framework deeply integrated with mainland China’s broader goals of global economic integration, supply chain resilience, and technological advancement. This shift is characterised by a strategic pivot towards “small and beautiful” projects that are green, digital, aligned with global chain dynamics, and concentrated on key regions, such as ASEAN and the Middle East. Mainland China is also leveraging multilateral trade frameworks, such as the Regional Comprehensive Economic Partnership (RCEP), to promote BRI direct investment.

The accelerating trade and investment connections under the BRI have also catalysed a structural surge in cross-border RMB demand. This is further facilitated by institutionalised mechanisms, such as bilateral currency swap agreements, and the expansion of RMB denominated trade settlement. As of May 2025, there are 32 bilateral currency swap agreements between the People’s Bank of China (PBoC) and other central banks and monetary authorities, among which 22 have BRI agreements with mainland China (PBoC, 10 June 2025).

Hong Kong is also poised to benefit from its unique position as a regional green and sustainable finance hub and the largest offshore RMB centre. As mainland China accelerates green transitions at home as well as in BRI economies, Hong Kong has ample opportunities to leverage its advantages in green finance. The city also has room to play an enhanced super connector role and facilitate broader use of the RMB internationally, such as in BRI economies, as well as creating venues for foreign investors to access an increasingly mature capital market with various options of RMB-denominated assets and risk management tools.

Disclosure appendix

This document is for information purposes only and should not be regarded as an offer to sell or as a solicitation of an offer to buy the securities or other investment products mentioned in it and/or to participate in any trading strategy. Information in this document is general and should not be construed as investment advice, given it has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Accordingly, investors should, before acting on it, consider the appropriateness of the information, having regard to their objectives, financial situation and needs and, if necessary, seek professional investment and tax advice.

Certain investment products mentioned in this document may not be eligible for sale in some states or countries, and they may not be suitable for all types of investors. Investors should consult with their HSBC representative regarding the suitability of the investment products mentioned in this document and take into account their specific investment objectives, financial situation or particular needs before making a commitment to purchase investment products.

The value of and the income produced by the investment products mentioned in this document may fluctuate, so that an investor may get back less than originally invested. Certain high-volatility investments can be subject to sudden and large falls in value that could equal or exceed the amount invested. Value and income from investment products may be adversely affected by exchange rates, interest rates, or other factors. Past performance of a particular investment product is not indicative of future results.

HSBC and its affiliates will from time to time sell to and buy from customers the securities/instruments (including derivatives) of companies covered here on a principal or agency basis. Whether, or in what time frame, an update of this information will be published is not determined in advance.

Additional disclosures

- This report is dated as at 12 September 2025.

- All market data included in this report are dated as at close 11 September 2025, unless a different date and/or a specific time of day is indicated in the report.

- HSBC has procedures in place to identify and manage any potential conflicts of interest that arise in connection with its Research business. HSBC's analysts and its other staff who are involved in the preparation and dissemination of Research operate and have a management reporting line independent of HSBC's Investment Banking business. Information Barrier procedures are in place between the Investment Banking, Principal Trading, and Research businesses to ensure that any confidential and/or price sensitive information is handled in an appropriate manner.

- You are not permitted to use, for reference, any data in this document for the purpose of (i) determining the interest payable, or other sums due, under loan agreements or under other financial contracts or instruments, (ii) determining the price at which a financial instrument may be bought or sold or traded or redeemed, or the value of a financial instrument, and/or (iii) measuring the performance of a financial instrument or of an investment fund.

Disclaimer

This document is prepared by The Hongkong and Shanghai Banking Corporation Limited (‘HBAP’), 1 Queen’s Road Central, Hong Kong. HBAP is incorporated in Hong Kong. This document is for general circulation and information purposes only. This document is not prepared with any particular customers or purposes in mind and does not take into account any investment objectives, financial situation or personal circumstances or needs of any particular customer. HBAP has prepared this document based on publicly available information at the time of preparation from sources it believes to be reliable but it has not independently verified such information. The contents of this document are subject to change without notice.

This document is not investment advice or recommendation nor is it intended to sell investments or services or solicit purchases or subscriptions for them. You SHOULD NOT use or rely on this document in making any investment decision or decision to buy or sell currency. HBAP is not responsible for such use or reliance by you. You SHOULD consult your professional advisor in your jurisdiction if you have any questions regarding the contents of this document.

You SHOULD NOT reproduce or further distribute the contents of this document to any person or entity, whether in whole or in part, for any purpose. This document may not be distributed to the US, Australia or any other jurisdiction where its distribution is unlawful.

Hong Kong

In Hong Kong, this document is distributed by HBAP to its customers for general reference only. HBAP is not responsible for any loss, damage or other consequences of any kind that you may incur or suffer as a result of, arising from or relating to your use or reliance of this document. HBAP gives no guarantee, representation or warranty as to the accuracy, timeliness or completeness of this document.

India

In India, this document is distributed for general reference by The Hongkong and Shanghai Banking Corporation Limited, India (HSBC India), having its India corporate office at 52/60, Mahatma Gandhi Road, Fort, Mumbai 400 001. HSBC India is not responsible for any loss, damage or other consequences of any kind that you may incur or suffer as a result of, arising from or relating to your use of or reliance on this document. HSBC India gives no guarantee, representation or warranty as to the accuracy, timeliness or completeness of this document and clients should contact their relationship manager in respect of any clarifications arising from or in connection with this document.

Malaysia

In Malaysia, this document, which has been prepared by HBAP, is issued and distributed by HSBC Bank Malaysia Berhad (127776-V) / HSBC Amanah Malaysia Berhad (807705-X) (the "Bank").

The Bank is not responsible for any loss, damage or other consequences of any kind that you may incur or suffer as a result of, arising from or relating to your use of or reliance on this document.

Singapore

In Singapore, this publication is distributed by The Hongkong and Shanghai Banking Corporation Limited, Singapore Branch, for the general information of institutional investors or other persons specified in Sections 274 and 304 of the Securities and Futures Act (Chapter 289) (“SFA”) and accredited investors and other persons in accordance with the conditions specified in Sections 275 and 305 of the SFA. Only Economics or Currencies reports are intended for distribution to a person who is not an Accredited Investor, Expert Investor or Institutional Investor as defined in the SFA. The Hongkong and Shanghai Banking Corporation Limited, Singapore Branch, accepts legal responsibility for the contents of reports pursuant to Regulation 32C(1)(d) of the Financial Advisers Regulations. This publication is not a prospectus as defined in the SFA. It may not be further distributed in whole or in part for any purpose. The Hongkong and Shanghai Banking Corporation Limited, Singapore Branch, is regulated by the Monetary Authority of Singapore. Recipients in Singapore should contact a “The Hongkong and Shanghai Banking Corporation Limited, Singapore Branch” representative in respect of any matters arising from, or in connection with, this report. Please refer to The Hongkong and Shanghai Banking Corporation Limited, Singapore Branch’s website at www.business.hsbc.com.sg for contact details.

Miscellaneous

Notwithstanding this document is not investment advice, please be aware of the following for the sake of completeness. Past performance is not an indication of future performance. The value of any investment or income may go down as well as up and you may not get back the full amount invested. When an investment is denominated in a currency other than the local currency of an investor, changes in the exchange rates may have an adverse effect on the value, price or income of that investment. Where there is no recognised market for an investment, it may be difficult for an investor to sell the investment or to obtain reliable information about its value or the extent of the risk associated with it.

This document contains forward-looking statements which are, by their nature, subject to significant risks and uncertainties. Such statements are projections, do not represent any one investment and are used for illustration purpose only. Customers are reminded that there can be no assurance that economic conditions described herein will remain in the future. Actual results may differ materially from the forecasts/estimates. No assurance is given that those expectations reflected in those forward-looking statements will prove to have been correct or come to fruition, and you are cautioned not to place undue reliance on such statements. No obligation is undertaken to publicly update or revise any forward-looking statements contained in this document or any other related document whether as a result of new information, future events or otherwise.

The Hongkong and Shanghai Banking Corporation Limited, its affiliates and associates and their respective officers and/or employees, may have interests in any products referred to in this document by acting in various roles including as distributor, holder of principal positions, adviser or lender. The Hongkong and Shanghai Banking Corporation Limited, its affiliates and associates, and their respective officers and employees, may receive fees, brokerage or commissions for acting in those capacities. In addition, The Hongkong and Shanghai Banking Corporation Limited, its affiliates and associates, and their respective officers and/or employees, may buy or sell products as principal or agent and may effect transactions which are not consistent with the information set out in this document.

© Copyright 2025, The Hongkong and Shanghai Banking Corporation Limited, ALL RIGHTS RESERVED. No part of this document may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior written permission of The Hongkong and Shanghai Banking Corporation Limited.