- Article

- Infrastructure and Sustainable Finance

- Transition to Net Zero

SEEDing change: A practical ESG framework for Hong Kong enterprises

Sustainability and Environmental, Social and Governance (ESG) considerations have become essential factors that shape how businesses operate and grow in today’s market.

We recently hosted a roundtable discussion for Technology, Media and Telecommunications, Healthcare and Pharmaceuticals, Services and Consumer sectors, that focused on how businesses could approach ESG in a practical, manageable way, and insights shared were relevant across Hong Kong’s diverse commercial landscape.

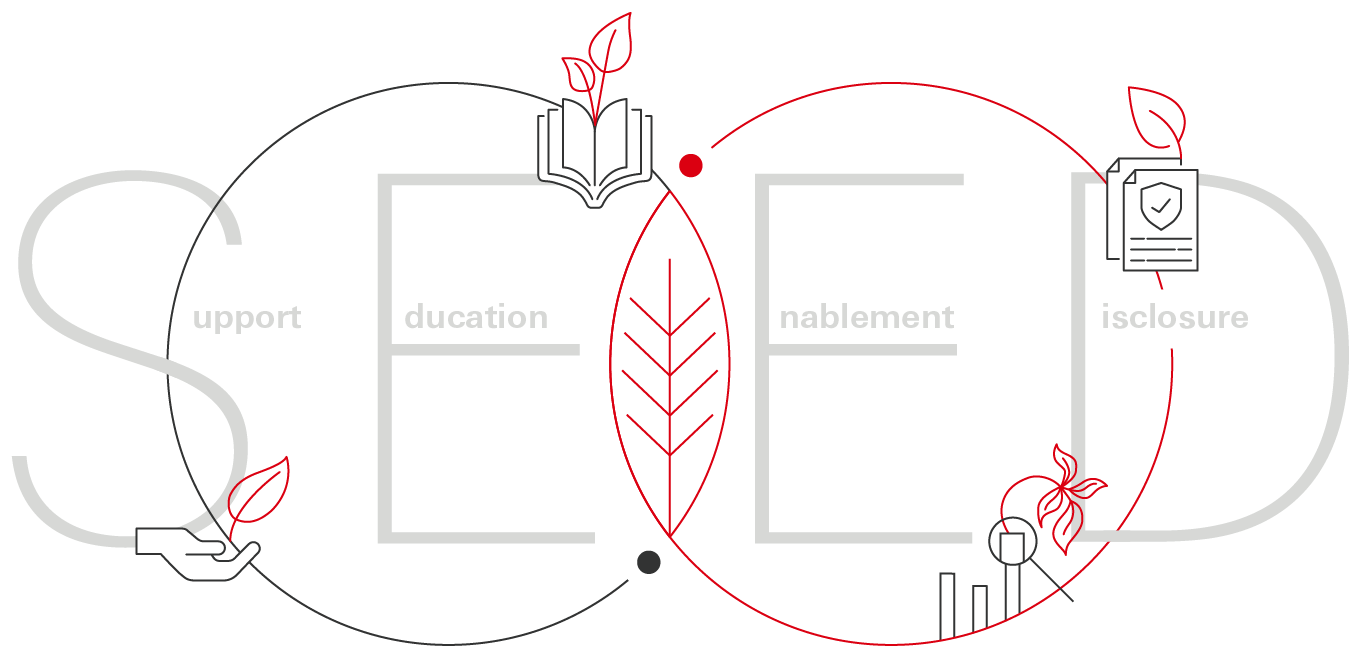

To summarise these key takeaways, we introduce the SEED framework, Support, Education, Enablement and Disclosure. These four pillars capture the key elements that help businesses starting their ESG journey effectively integrate sustainability into their operations.

Why ESG matters to businesses of all sizes in Hong Kong?

- Hong Kong has become one of the first jurisdictions globally to fully align its local sustainability disclosure requirements with the IFRS Sustainability Disclosure Standards (ISSB Standards). 1 This milestone reflects the city’s commitment to enhancing transparency in sustainability reporting and its ambition to strengthen its position as a global sustainable finance hub.

- The disclosure framework primarily targets publicly accountable entities and listed companies, with phased compliance starting in 2025 and mandatory adoption by 2028. However, non-listed companies are increasingly recognising the need to prepare for these changes and to embed sustainability into their business models.

- SMEs is a vital part of the supply chains for listed companies, large non-listed firms, and multinational corporations operating in Hong Kong. Their ability to collect and share sustainability-related information supports these larger companies’ ESG commitments.

Sector snapshots: Key opportunities

Healthcare and Pharmaceuticals |

|

Services |

|

Consumer |

|

Technology, Media and Telecom (TMT) |

|

Overcoming ESG challenges: The SEED Approach

Many businesses face common challenges: limited time, expertise, and resources to develop and implement ESG strategies. The SEED framework may offer a clear path forward.

Support

- Developing a sustainability strategy can be challenging, especially when balancing day-to-day business demands.

- We launched the HSBC Sustainability Improvement Loan to help improve businesses’ access to sustainable finance, particularly for those in the early stages of their sustainability journeys.

- This loan links the cost of financing to sustainability performance improvements, assessed and rated by EcoVadis, one of the leading global providers of sustainability intelligence and ratings. ⁹

- This year, we’ve also introduced Energywi$e and Wastewi$e Certificates under Hong Kong Green Organisation Certification into the programme. These assessments help companies benchmark their energy efficiency and waste management, identify areas for improvement and support ongoing progress.

Education

- Educational institutions can contribute to sustainable development by integrating long-term thinking into their curricula and research priorities.

- By integrating ESG principles into the curricula and partnering with industry organisations for pre-employment training, educational institutions can help develop workforce capabilities aligned with sustainability-related skills and practices.

- Corporates can further support their workforce through capacity building, industry roundtables and programmes that facilitate knowledge sharing and access to useful resources, enabling employees to contribute effectively to their organisation’s sustainability goals.

Enablement

- Digital tools are increasingly important for businesses to monitor and improve their ESG performance while reducing compliance and reporting costs.

- Platforms like Diginex and MioTech offer intuitive, accessible data analytics, sustainability reporting and risk management solutions that connect business data and helps break down data silos.

- This supports businesses to improve energy efficiency, track and reduce carbon emission, and assess ESG and climate risks across operations and value chains.

- Our HSBC Sustainability Tracker also offers a simple, free to use self-assessment tool that gives businesses suggestions to drive sustainable improvements while allowing them to benchmark against similar companies.

Disclosure

- Transparent ESG disclosure can help businesses demonstrate their commitment to sustainability and respond to increasing stakeholder expectations.

- Certification bodies offer tailored services to help businesses verify and communicate their sustainability credentials. These certifications provide credible, independent assurance of a company’s ESG practices, which can enhance trust with customers and business partners.

Sustainability is not about perfection but progress. For businesses in Hong Kong, the above SEED framework could offer a practical roadmap to plant the seeds of meaningful change and responsible growth.

By taking deliberate, measurable steps and seeking expert guidance, businesses across industries can transform ESG from a compliance checklist into a catalyst for innovation, resilience and long-term value creation. At HSBC, we will continue to help businesses strategically tap into ESG opportunities, partnering with them every step of the way.

|

Today we finance a number of industries that significantly contribute to greenhouse gas emissions. We have a strategy to help our customers to reduce their emissions and to reduce our own. Find out more about our climate strategy.

Reminder “To borrow or not to borrow? Borrow only if you can repay!”

Where this document makes references to other websites or pages on the internet owned by third parties, such references are included for information purposes only. HSBC is not responsible for the contents of any third party websites or pages referred to in this document and no liability is accepted whatsoever for any direct, indirect, or consequential loss (whether arising in contract, tort or otherwise) arising from the use of or reliance on the information contained in any of these third party websites or pages. If you seek to rely in any way whatsoever upon any content contained on a third party website or page referred to in this document, you do so at your own risk. No endorsement or approval of the appropriateness of any third parties or their advice, opinions, information, products or services is expressed or implied by the inclusion in this document of any information derived from or references to any third party websites or pages.

1 https://www.info.gov.hk/gia/general/202506/12/P2025061200525.htm

2 https://www.nature.com/articles/s41893-024-01374-y

3 https://pubmed.ncbi.nlm.nih.gov/35730333/

5 https://rlp.asia/en/sbti-actions/

6 https://www.inriver.com/resources/brands-circular-economy/

8 https://www.iea.org/reports/energy-and-ai/executive-summary

9 https://www.about.hsbc.com.hk/news-and-media/hsbc-launches-sustainability-improvement-loan