See, move, and manage your money across the world instantly. Designed for businesses with international treasury needs - we're making real-time treasury a reality.

HSBC Tokenised Deposit Service

Take your treasury into tomorrow

Instant cross-border payment and settlement

Move money 24/7, 365 days a year, without cut-off times

Real-time visibility of your transactions

API powered; live balances recorded in real-time

Seamless connectivity

Trigger payment requests from your enterprise system

Equal deposit value

Whether in token form or fiat, your deposits retain their value

Benefits for your business

Frees up trapped capital

Move money instantly to where it's needed. Take advantage of immediate business opportunities.

Automated workflows

Instructions trigger automatic money movement in multiple currencies, across locations, without operational delays.

Accurate forecasting

Make more informed decisions with real-time visibility of your funds, across your accounts globally.

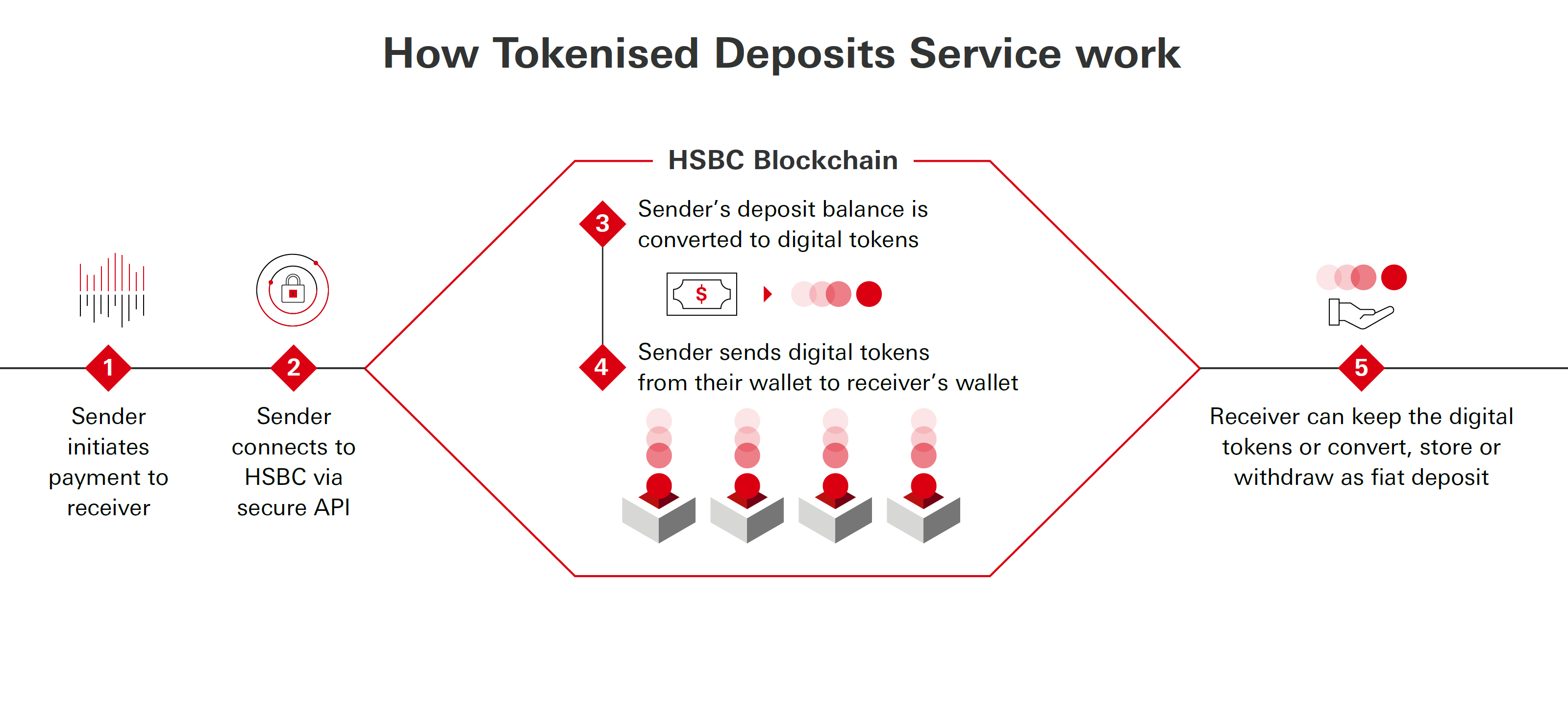

How it works

This service allows you to manage and move funds across participating HSBC locations in real-time, 24/7 by converting deposits into digital tokens (1:1, or one token for every dollar), enabling instant wallet-to-wallet transfers. Have full visibility and control over your cash – all within HSBC’s network.

Secure and transparent

- Built on a private HSBC blockchain

- Visibility over real-time balances on blockchain wallets

- Enterprise grade security and permissions

Related content

Ant International shares how they have used Tokenised Deposit Service to instantly transfer funds between its entities.

Hong Kong Monetary Authority uses HSBC Orion to complete world’s first multi-currency digital bond offering.

Frequently asked questions

Disclaimer

The information contained on this website is provided for informational purposes only, and does not constitute an offer to sell or the solicitation of an offer to buy any products referenced. Eligibility criteria and T&Cs apply for the products referenced. Local country restrictions and limits may apply. Please speak with your HSBC representative for more information.

For Singapore, Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

Need help?

If you have question about our products and services, please click ‘Chat with us’.