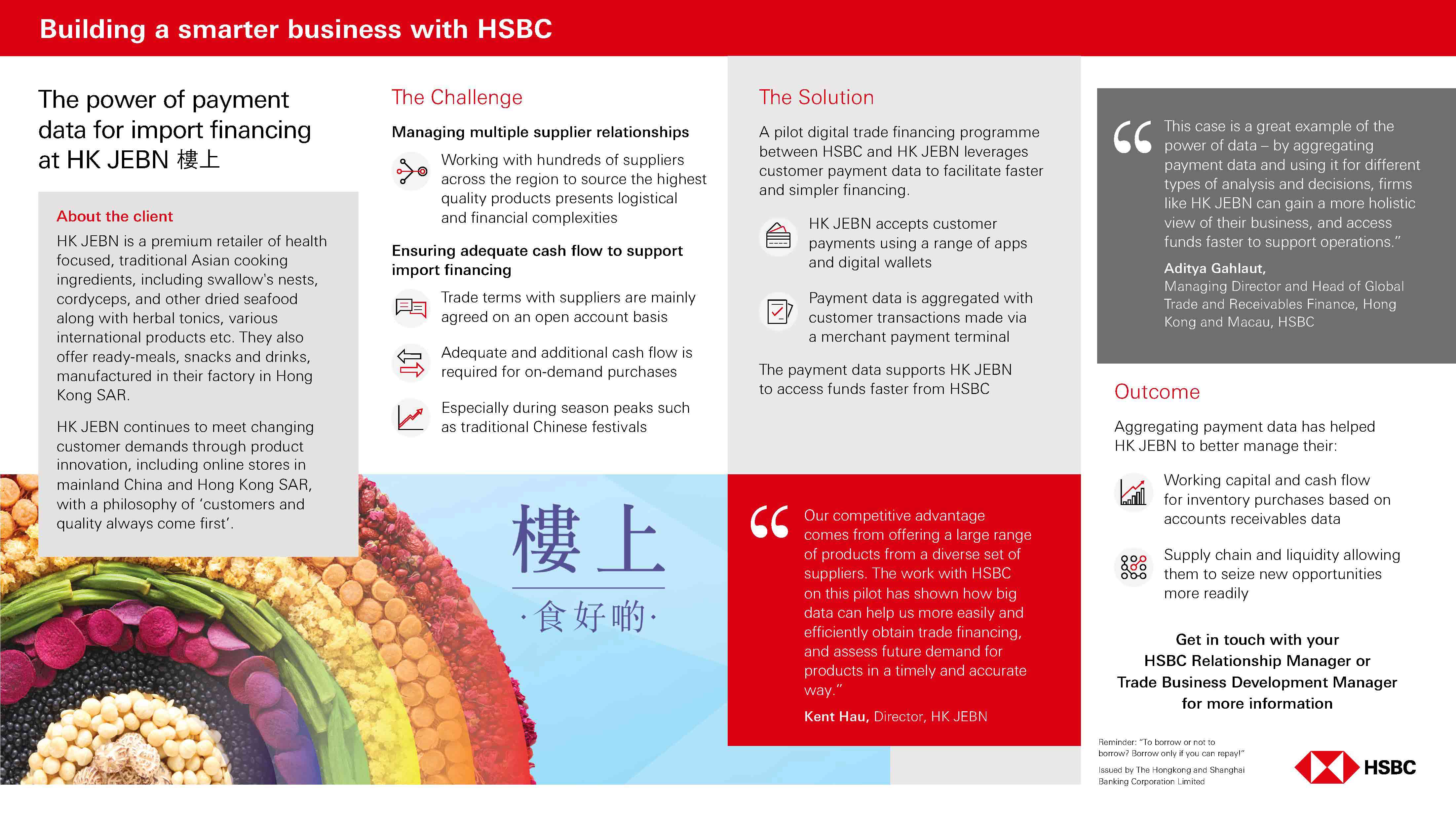

HSBC launched a first-to-market banking solution of Point-of-Sale Financing for business-to-business (B2B) transactions in Hong Kong that enables B2B sellers to offer extended terms of payment to their business and institutional customers on their online platforms.

Through the API technology, a seamless and fully embedded financing option will be available for HSBC customers’ B2B e-Commerce platform where HSBC will pay its commercial clients in one business day after they receive a purchase order to enhance overall efficiency and working capital optimization of the customers.

The solution is now available on FreightAmigo, a leading digital freight logistics platform, to enable its business users to ship now, pay later. When a company places shipment booking on the platform, they can opt to pay on extended terms at no extra cost, uplifting the digital customer experience and providing greater payment flexibility.

Benefits:

![]() Ship now, pay later. Enable buyers to pay on extended terms at no cost

Ship now, pay later. Enable buyers to pay on extended terms at no cost

![]() Provide greater flexibility on cash flow and working capital

Provide greater flexibility on cash flow and working capital

![]() Enhance digital customer experience

Enhance digital customer experience