Why you'll want it

Easy access to major currencies

- Purchases and cash withdrawals in 12 major currencies will be debited directly from your Business Integrated Account*

- Access to global ATM networks^

No fees, and extra rewards

- Earn an uncapped 0.5% instant cash rebate on eligible spending

- No handling fee for foreign currency transactions

- No handling fee for local cash withdrawals from HSBC network ATMs in Hong Kong

- No annual fee

Seamless contactless payments

- Make contactless, card-not-present (CNP) and mobile wallet payments including Apple Pay, Google Pay™ and Samsung Pay™

- Link your HSBC Business Debit Mastercard to Alipay to enjoy greater convenience and easily settle everyday transactions from ride-hailing to simple meals.

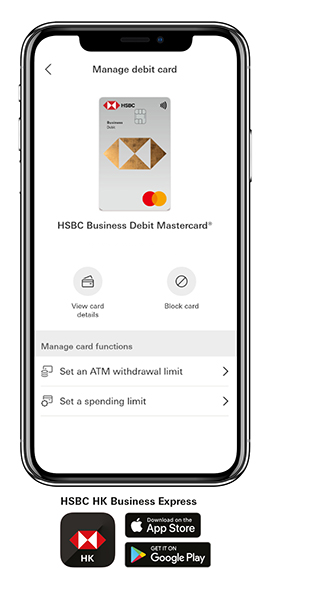

Always in control

- More control and transparency on who makes payments, where and when

- Instant SMS notifications on all card-not-present (CNP) transactions and changes to transaction limit

* Your spending in 12 major currencies will be debited directly from the corresponding foreign currency deposits in your Business Integrated Account if sufficient funds are in place. These currencies include AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, RMB, SGD, THB, USD. Any transactions outside of these currencies or there are insufficient funds in relevant currency(ies), they will be settled in HKD according to the prevailing exchange rate.

^ Cash withdrawal in RMB is not applicable via HSBC network ATM in Hong Kong.