Sustainable Finance in the GBA

Current development and future prospects

HSBC’s support to the green transformation of businesses

The pace and scale of China’s economic transformation into the second-largest economy1 in the world has no historical precedent. Its 30-year economic boom and urbanisation greatly improved people’s living standards, yet this has come at a cost: a surge in urban waste.

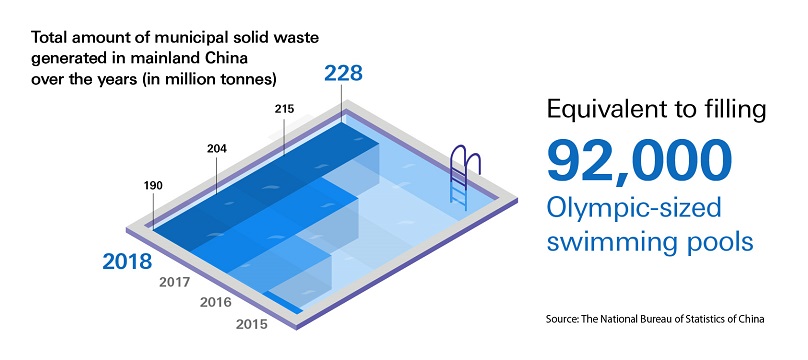

China produced nearly 230 million tonnes of municipal solid waste (MSW) in 2018.2 This is equivalent to filling 92,000 Olympic-sized swimming pools.

The Chinese Central Government (Central Government) has been advocating for the implementation of initiatives that will safely dispose of solid waste and encourage reduction and recycling. This has presented a shift away from traditional landfill methods to more environmentally friendly and sustainable solutions such as waste-to-energy (WTE) technologies.

Chapter 1: Turning trash into power

Canvest Environmental Protection Group Company Limited (Canvest), a Chinese leading WTE company headquartered in Hong Kong, has been making great strides to address China’s waste issue. As of March 2020, the daily MSW processing capacity of the company’s 30 projects across 12 provinces and municipalities in China reached over 45,000 tonnes.3

WTE is a sustainable, clean and effective way to process MSW by converting non-recyclable waste into usable forms of energy. During the process, the combustion of waste generates steam that drives turbo generators to produce electricity. The technology reduces the demand for landfills and fossil-fuelled power plants which release harmful toxins and greenhouse gases into the air and waterways.

In recent years, many developed countries have adopted WTE technologies as their key source of waste treatment. In 2018, over 50% of waste produced in Finland, Sweden and Norway was incinerated through WTE technologies;4 while Japan reported around 70% in 2019.5

“Canvest is committed to addressing environmental pollution, while at the same time, transforming waste into sustainable energy. In that way, we are fostering a harmonious coexistence of economic development and the natural environment and this is closely aligned with our mission of ‘protecting green ecology and contributing to clean energy’.” said Loretta Lee, Chairlady of Canvest.

“In 2019, Canvest processed over 5.9 million tonnes of MSW through its WTE technology and sold around 2 million MW of green electricity. This equated to forgoing 630,000 tonnes of standard sized coals and offsetting over 2.8 million tonnes of carbon dioxide equivalent emissions.” according to Lee.

Chapter 2: Lucid Waters and Lush Mountains

Vast opportunities for WTE technologies in the region are expected given China’s ambitious plans to tackle its waste. As part of its Thirteenth Five Year Plan, the Central Government driven by its ‘Lucid Waters and Lush Mountains are Invaluable Assets’ concept has developed the ‘Beautiful China’ initiative. Part of the initiative is to encourage cities and counties across China to increase their sustainable management of MSW. The development of the Guangdong-Hong Kong-Macao Greater Bay Area (GBA) adds to the company’s positive outlook on Southern China. The plans for the GBA, introduced in 2019, highlight green energy and environmental protection as key areas for development.

Looking specifically at Guangdong, in 2018 it was the largest waste producing province in China. In addition, the province’s cities of Guangzhou and Dongguan, were among the top ten cities in China with the largest production of MSW.6 Fortunately, this is also where Canvest has a significant presence. “We are the largest private WTE company in Guangdong province with 14 operating plants across the region that processes a daily waste capacity of 22,000 tonnes,” said Lee.

“As the region continues to develop economically, alongside the steady growth in population and waste generated, we should expect an increase in demand for environmental investment. Canvest will continue to play a leading role in promoting WTE technologies to enhance conservation and the sustainable development of the region.” stated Lee.

Chapter 3: Green finance to support

In response to these trends, Canvest has been expanding across the two main streams of the solid waste management industry: supply chain and third-party channels. To make this possible, HSBC Hong Kong has provided project funding for Canvest through green financing solutions and HSBC China has provided the same support through its Sustainable Financing Programme. The funds and incentives will support Canvest’s acquisitions and help optimise WTE projects to streamline efficiencies and reduce operating costs.

HSBC China is the first foreign-funded bank to offer this kind of incentive scheme in mainland China.7

Lee spoke openly about business operations, “The WTE business is very capital intensive. Not only does it require a large amount of capital for project development, operations, and optimisation, but the increasingly tightening disclosure agreements from regulatory institutions and stakeholders has increased our operating costs,”

“With HSBC’s green and cash revolving loans we can effectively plan our business and improve our cash flow. This is crucial to our expansion in the region.” added Lee.

Neo Wang, Co-Chief Executive and Head of Commercial Banking, Guangdong, HSBC, said, “We believe that green finance is integral to building a sustainable economy and this is strongly reflected in our business strategy. In addition, HSBC will continue to work closely with the government and other organisations to promote sustainable development through the exploration of green finance solutions for the GBA and the entire country.”

HSBC’s commitment to sustainability is further reflected by its pledge to provide and facilitate sustainable financing and investments worth USD100 billion by the end of 2025. The bank also has a diverse range of sustainable finance solutions to meet the needs of clients from different industries as well as providing capital for businesses to invest in assets to reduce carbon emissions. HSBC also has solutions to cover green energy, construction, and transportation.

David Harrity, Managing Director, Growth Propositions, Commercial Banking, Hong Kong, HSBC, added, “As a global financial institution that plays a key role in promoting the development of green finance, HSBC is committed to helping businesses in the GBA to achieve their sustainable development visions through our innovative solutions and expertise, and to seize opportunities arising from the region’s transformation to a low-carbon and high-quality economy.”

Chapter 4: Working together for a better future

Looking ahead, Canvest will focus on adopting new technologies and methods to promote the development of clean green energy. The company also plans to further reduce gas emissions and resource consumption to support China’s efforts to fight climate change and continue its growth story in a sustainable manner.

“We remain committed to creating a sustainable model to support urbanisation and thanks to HSBC’s diverse and flexible green finance solutions we are moving closer towards living out our vision,” said Lee.

She added, “Canvest’s longstanding, trusting relationship with HSBC and working together to achieve sustainable development is also a key part of what being sustainable is really about.”

Eurostat figures for Municipal Waste Treatment 2018, Confederation of European Waste-to-Energy Plants

Asia-Pacific Waste-To-Energy (WTE) Market 2019-2027, Triton Market Research

https://www.about.hsbc.com.cn/-/media/china/zh-cn/news-and-media/200102-press-release-cn.pdf

Disclaimer

HSBC has based the information contained herein on information obtained from sources it believes to be reliable but which it has not independently verified. The information, findings, projections, representations, opinions and/or comments in the information contained herein are subject to change from time to time without any obligation on HSBC to give notice of such change to you and should not be construed as any recommendation or advice.

The views and opinions expressed in the information contained herein are those of the individuals and/or the organisations represented by the individuals and, except where an individual is specifically identified as a representative of HSBC, do not state or reflect the views or opinions of HSBC. These views and opinions are subject to change without notice and without any obligation on HSBC to give notice of such change, and should not be construed as any recommendation or advice.

HSBC makes no representation or warranty (express or implied) of any nature nor is any responsibility of any kind accepted with respect to the completeness or accuracy or reliability of any information, projection, representation or warranty (expressed or implied) in, or omission from, the information contained herein. No liability is accepted whatsoever for any direct, indirect or consequential loss (whether arising in contract, tort or otherwise) arising from the use of or reliance on the information contained herein or any information contained in the information contained herein by the recipient or any third party.

Where the information contained herein makes references to other websites or pages on the internet owned by third parties, such references are included for information purposes only. HSBC is not responsible for the contents of any third party websites or pages referred to in the information contained herein and no liability is accepted whatsoever for any direct, indirect, or consequential loss (whether arising in contract, tort or otherwise) arising from the use of or reliance on the information contained in any of these third party websites or pages. If you seek to rely in any way whatsoever upon any content contained on a third party website or page referred to in the information contained herein, you do so at your own risk. No endorsement or approval of the appropriateness of any third parties or their advice, opinions, information, products or services is expressed or implied by the inclusion in the information contained herein of any information derived from or references to any third party websites or pages.

Nothing in the information contained herein is intended by HSBC to be construed as financial, legal, accounting, tax and/or other advice. No consideration has been given to the particular business objectives, financial situation or particular needs of any recipient. Any examples given are for the purposes of illustration only. Recipients should not rely on the information contained herein in making any decisions and they should make their own independent appraisal of and investigations into the information described in the information contained herein. If you seek to rely in any way whatsoever upon any content contained in the information contained herein, you do so at your own risk. HSBC recommends that before you make any decision or take any action that might affect you or your business, you consult with suitably qualified professional advisers to obtain the appropriate financial, legal, accounting, tax and/or other advice.

Reminder: “To borrow or not to borrow? Borrow only if you can repay!”

Contact us

+852 2748 8288 press #, 7, 1 after language selection

Download “Greater bay, greater opportunities” brochure to find out more (PDF, 2.06MB)

Speak to your HSBC relationship manager to find out more.

Need help?

Get in touch to learn more about our banking solutions and how we can help you drive your business forward.