Our new HSBC Business Debit Mastercard gives you full control of your finances with flexibility and reliability. You can easily manage your business debit card, expenses and oversee card transactions with HSBC Business Internet Banking and HSBC HK Business Express mobile app – allowing you to stay agile and ahead for more opportunities.

Card

HSBC Business Debit Mastercard®

You can now apply for an HSBC Business Account online!

With over 34 million merchant locations worldwide, the HSBC Business Debit Mastercard allows you to transact anytime, anywhere with greater control over your business spending with no annual and transaction handling fees.

The first Business Debit Mastercard in Hong Kong

Watch the videos to learn more

See how Cecilia So stays on top of her business with our new HSBC Business Debit Mastercard.

Flexibility is key when it comes to controlling business spending. Find out how Cecilia manages the spending limits for her employees with the HSBC HK Business Express mobile app.

Cecilia is always on the lookout for the finest local ingredients from around the world for her business. Discover how she transacts in 12 major currencies at preferential rates.

Turn business expenses into rewards! See how Cecilia earns an uncapped 0.5% immediate cash rebate on eligible business spending.

Product Benefits

Stay in control at all times

- Greater control and transparency on who makes payments, and where and when they are made

Connect to the world

- Access to global ATM networks, and support transactions in multiple currencies

Seize more opportunities

- Make in-store and online payments more quickly and easily to capitalise on business opportunities

Save more

- No handling fee for foreign currency transactions*

- No handling fee for local cash withdrawals from HSBC network ATMs

- No annual fee

Earn extra

- Earn an uncapped 0.5% immediate cash rebate on all eligible transactions

And more…

- Manage card controls on HSBC HK Business Express mobile app#

- eCommerce protection guarantees up to USD500 per occurrence and annually^

- Support contactless card-not-present (CNP) and e-wallet payments including Apple Pay and Google Pay

- Instant SMS notifications on all CNP transactions and transaction limit amendments

- Support in-store, online and ATM transactions at any Mastercard-accepting vendor to reduce cash handlings

* Your spending in 12 major currencies will be debited directly from the corresponding foreign currency deposits in your Business Integrated Account if sufficient funds are in place. These currencies include AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, RMB, SGD, THB, USD.

# Card control features are only available to customers with access to the HSBC HK Business Express mobile app

^ The eCommerce purchase protection insurance is underwritten by AIG Insurance Hong Kong Limited, to which HSBC is the Policyholder. Details and claims are subject to the applicable terms and conditions(PDF,266KB).

Merchant offers and privileged experiences

Enjoy a range of spending discounts and special perks. Discover the many ways to reward yourself.

How to apply

Existing HSBC Business Internet Banking users

Not a Business Internet Banking registered user?

Don’t yet have an HSBC Business Integrated Account?

HSBC will replace all standalone ATM cards of Business Integrated Account with the new HSBC Business Debit Mastercard by phases from 2022.

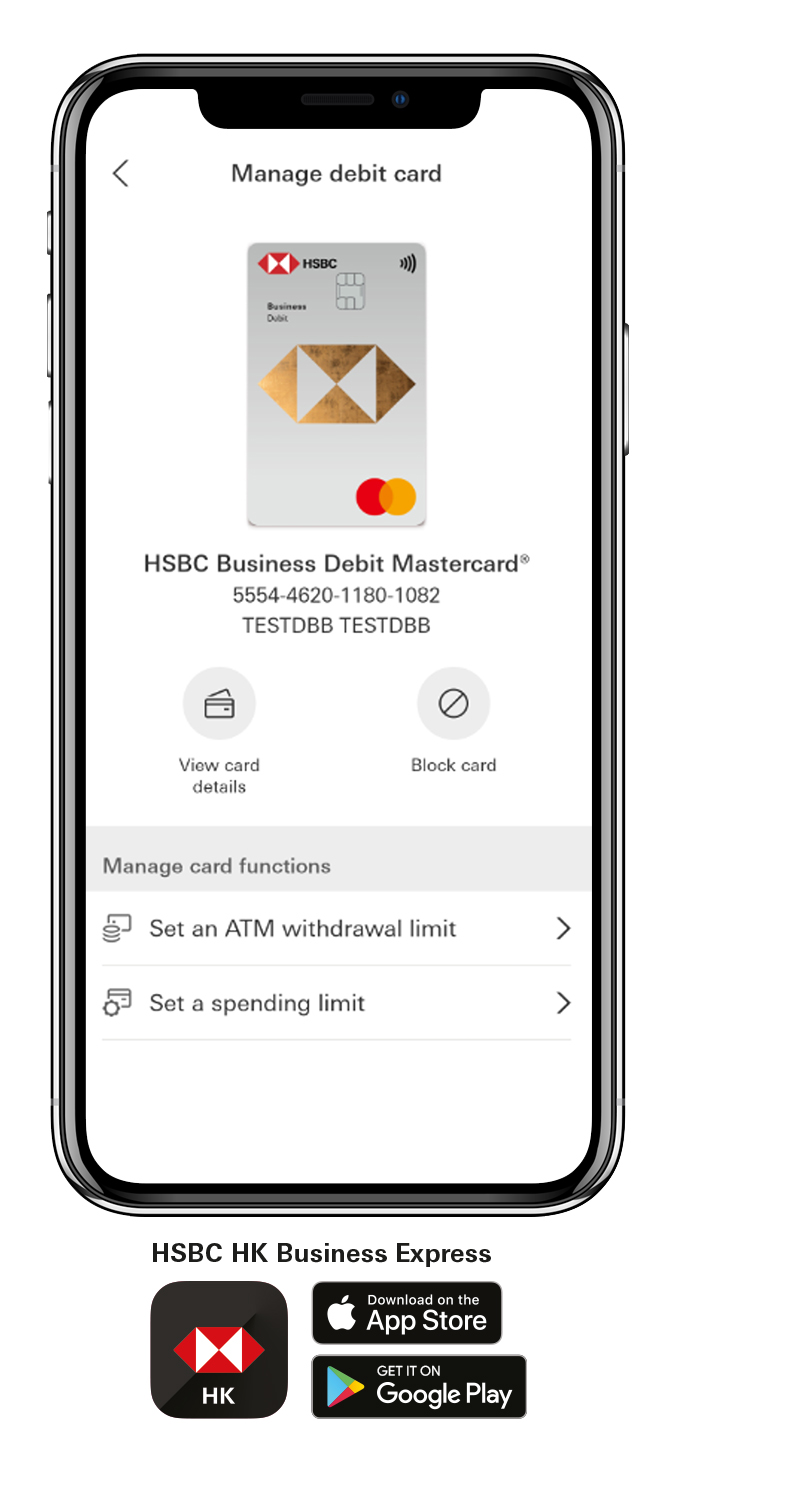

Manage your card with HSBC HK Business Express mobile app*

Control usage

- Block/unblock cards temporarily

Control spending

- Set daily and monthly spending limits

- Set transaction limits on contactless, e-wallet and Card-Not-Present (CNP) transactions

Control ATM transactions

- Set limits on the amount of domestic/overseas ATM withdrawals

* Card control features are only available to customers with access to the HSBC HK Business Express mobile app

Learn more

Get started

Welcome offer

From now until 31 December 2022, you can receive an extra HKD500 cash rebate if you meet our eligible spending requirement*

Any questions… about commercial banking?

Need help?

If you have question about our products and services, please click ‘Chat with us’.