Doing business in Hong Kong

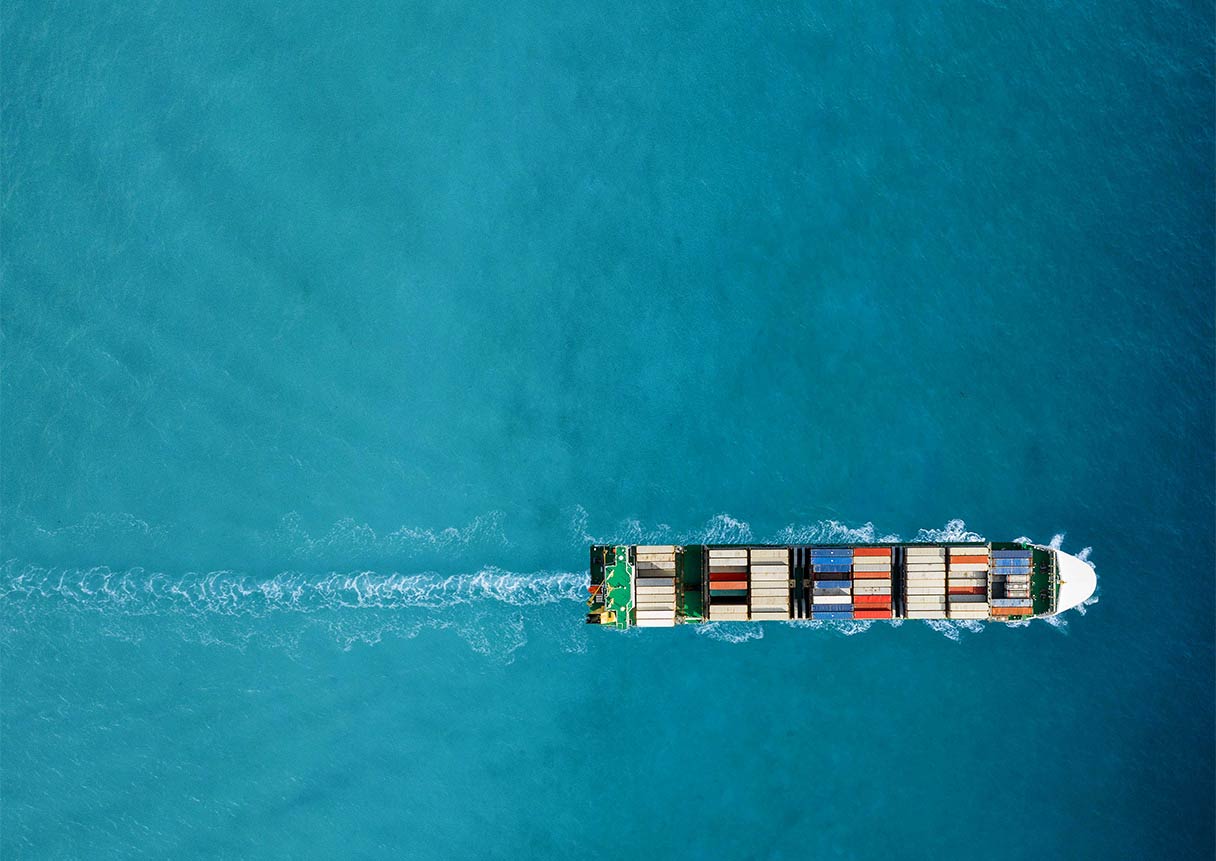

Bridging you to the Greater Bay Area and beyond

Find out how we can support your sustainability journey.

Find inspiration for your business from our expert opinions and customers' stories.

Guangdong-Hong Kong-Macao Bay Area (The Greater Bay Area) is an initiative that will form an exciting new chapter in South China’s history. The Greater Bay Area aims to bring together the two Special Administrative Regions of Hong Kong and Macao with nine cities in Guangdong.

HSBC and HKTVmall jointly launch an innovative digital trade financing programme that leverages commercial data for credit assessment and loan drawdown, making loans more accessible for the growing community of online merchants in Hong Kong.