- 5 mins

- Article

- Growing my Business

- Expanding internationally

Crossing borders with confidence: A guide to international trade and expansion

For ambitious businesses, the decision to expand internationally should not be taken lightly, as it requires careful planning and strategic risk management. However, if it is done successfully, the rewards can be transformative for those who are bold enough to take this path. In this guide, we'll explore the strategies and financial solutions that are vital for making your business a global success story.

In this article:

- The main advantages of going global

- The challenges of overseas expansion

- The main financial barriers to expanding internationally

- HSBC: powering your global growth

- Your checklist for navigating international markets

- How to get started

In today's interconnected world, the boundaries of business growth are no longer set by geography. For companies looking to expand their reach, navigating the complexities of global markets can seem daunting. But with the right partner by your side, you can unlock a wealth of opportunities that accelerate growth, mitigate risks, and give you a competitive edge.

The main advantages of going global

The benefits of expanding globally are vast. By entering international markets, companies can achieve economies of scale, thereby reducing costs. Crucially, accessing new markets also enables companies to generate additional revenue streams while effectively mitigating risks through diversification.

Improved brand recognition, together with the innovation fostered by the ability to hire globally and bring in new perspectives, also increases the company’s competitiveness.

These advantages are all highlighted by the compelling business case for growth through expansion. Despite uncertainties in the economic environment, global trade is showing robust growth: it's on track to hit an all-time high record of USD33 trillion in 2024, representing annual growth of 3.3%.1

In Hong Kong, local and multinational firms alike are taking advantage of the city's role as a super connector to facilitate their overseas business growth and expand into mainland China as well as the Greater Bay Area. In 2024, Invest Hong Kong assisted 539 overseas and Mainland companies to set up or bring their business to Hong Kong – a 41% increase compared with 2023 and a reflection of the city's success as a hub for expansion.2

There are also growing opportunities for companies who are looking to begin operating in the Association of South-East Asian Nations (ASEAN) and the Middle East.3

While the benefits of global expansion are clear, it's equally important to consider the challenges that companies must overcome if they are to achieve success. These challenges can be significant, and understanding them is crucial for developing effective strategies.

The challenges of overseas expansion

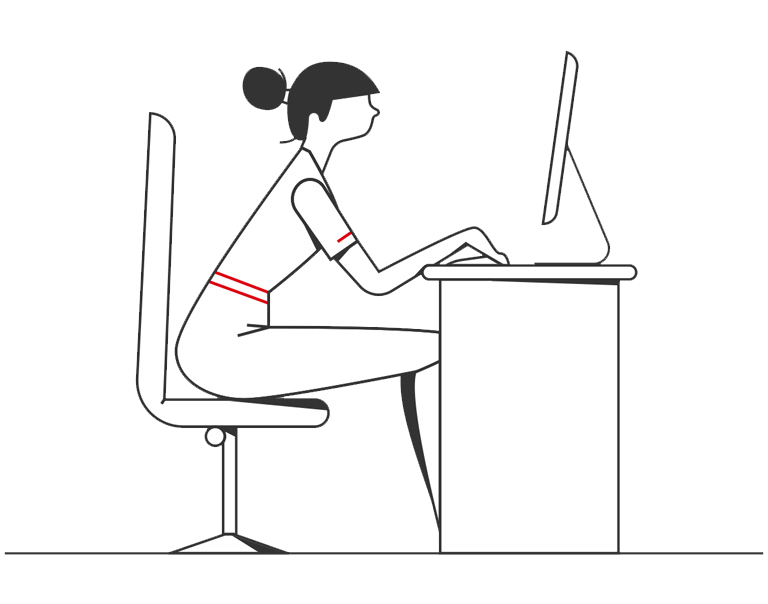

Cultural differences

Doing business overseas means having to engage in international trade. This involves interacting and building relationships with unfamiliar vendors in the supply chain, with nuances in their own local markets. Differences in culture and language can also be barriers to communication.

Compliance

Regulations and laws in different jurisdictions can be challenging to navigate. Companies expanding into new markets need to be well informed about these requirements in order to avoid unexpected delays, legal issues and disruptions to their supply chains.

Reaching local audiences

To reach customers in new markets, companies must adapt their communications, brand outreach and products to meet those customers' needs. Local competitors will also be well established and may have a deeper understanding of the nuances of their local market.

The main financial barriers to expanding internationally

Navigating the complexities of currency in international trade

Making and receiving cross-border payments and transactions while managing foreign exchange (FX) rates are critical in international trade. During phases of rapid expansion, paying suppliers on time can be challenging. Volatile exchange rates can lead to transactional losses and reduce profitability. Companies often try to mitigate these FX risks through hedging strategies.

Maintaining business liquidity and securing cashflow

Effective liquidity management is vital for supporting a growing international business. Companies face challenges in maintaining enough of a buffer against unforeseen cash-flow fluctuations and additional operating expenses caused by disruptions in the supply chain. Securing working capital is essential for smooth operations.

Payments and localisation

Handling payments in multiple currencies can be complex, requiring access to local expertise and solutions. Differing regulatory frameworks and compliance costs can increase transaction fees and slow down processing times.

HSBC: powering your global growth

As a bank that works closely with companies of all sizes around the world, we at HSBC understand the specific needs of companies who are planning to expand. As a global connector, our footprint provides access to 90% of world trade flows.4 With our strong local knowledge and our 160 years of experience in financing global trade, we offer a comprehensive set of solutions to support companies that are looking to start doing business internationally and in the Greater Bay Area.

Whether it's related to global trade, working capital solutions, payment collections or transaction banking, our products and services help our customers streamline the entire process and seamlessly do business overseas. Here are some of our solutions.

Trade solutions and payment solutions: manage your supply chains efficiently while seamlessly collecting and making payments

- HSBC Global Trade Solutions: connect your company to the world

Our wide range of tailored trade solutions allows companies to optimise their working capital and cashflow management, improve their supply chain resilience and understand the local nuances of their global expansion.

With extensive experience in trade financing across global markets, we serve as a trusted strategic partner for businesses. This wealth of expertise supports companies in identifying opportunities, managing risks, and adapting to evolving trade environments.

- HSBC TradePay: access a simplified digital trade finance solution

To help companies do business overseas with confidence, HSBC TradePay equips them with instant loan drawdowns and supplier payments6 . By simply uploading a payment file, companies can make just-in-time payments to suppliers.

This solution is fully integrated into HSBCnet, a single platform that gives customers full visibility of their finances – any time, anywhere.

- Payment and FX solutions: manage cross-border payments in up to 25 major currencies#

We provide real-time FX services^ with preferential rates through HSBCnet, Business Internet Banking and the HSBC Business Express mobile app. Companies can manage cross-currency conversions for up to 25 currencies, with real-time rates for transactions up to USD10 million. Whatever your foreign exchange and investment needs, HSBC's comprehensive FX services allow you to manage your FX needs easily.

- HSBC Digital Merchant Services: collect payments efficiently

With a single provider, this all-in-one solution resolves the complexities of managing multiple payment methods. It allows companies to receive digital payments efficiently and optimise their cash flow. Among the features offered are 24/7 support via multiple communication channels, and consolidated reporting to ease the reconciliation process.

Managing transactions and expenses: stay in full control of your cashflow

- HSBCnet: one platform to monitor all global accounts

HSBCnet is an all-in-one global banking platform that offers companies real-time visibility, seamless transactions and advanced security. With intuitive tools, 24/7 support and enterprise resource planning (ERP) integration, it simplifies payments, reporting and cash management so your business can run smarter and faster.

- HSBC Corporate Mastercard: manage your expenses overseas

As companies expand into new markets, managing employee travel expenses requires flexibility and control. The HSBC Corporate Mastercard provides this. It's an all-inclusive solution that allows companies to manage their business travel and entertainment expenses in a more efficient way. By linking HSBC Corporate Mastercard to digital wallets on mobile devices, expenses can be managed seamlessly on the go—whether it’s arranging a business luncheon, purchasing business supplies, or settling operating costs.

Your checklist for navigating international markets

- Assess the market and do your research

When considering international expansion, an important first step is to do an initial market assessment and conduct research to understand how to best position your business for success.

Our expertise across different markets and our knowledge of the local business environment can assist you with these considerations.

- Consider the legal and regulatory requirements

Understanding the laws and regulations on each aspect of running a business in the country your company is expanding into is crucial to avoid legal issues or disruptions to business.

- Assess the risk

Conducting a risk assessment and managing risks are key to avoiding complications in your expansion.

We offer an array of services designed to help companies manage their exposure. Access to our credit and lending services allows you to manage fluctuations in cash flow or to finance your capital investments. Our structured trade and import/export finance solutions can help your reduce counterparty risk.

- Have a market entry strategy

Having a market entry strategy is crucial for launching your company's brand.

With our global reach and local expertise, we have on-the-ground specialists in trade, financing and more to help your company set up businesses in new markets smoothly.

- Establish your business

Whether you've just started doing business in a new market or you've been operating in that market for a while, you may need support to keep your business running smoothly and efficiently.

We have an extensive range of solutions to support your business needs: from a business integrated account that lets you manage your finances across markets, to our real-time foreign exchange services and payment support, through to our International Trade Growth solutions.

- Find the right partner

A trusted banking partner can help companies with their expansion, and we are well placed to support you.

How to get started

With our strong global network, we are well positioned to be a trusted strategic partner in your international expansion. If you're facing challenges with your operations, financing or payments, we can give you the tools you need to overcome them. Our tailored range of solutions will empower you to expand into new markets and pursue your company’s growth ambitions.

Let us be your partner in success. Get started today by applying for an account here.

# Real-time exchange rates are applicable for foreign exchange transactions of 25 major currencies (HKD, USD, CNH, EUR, GBP, JPY, AUD, CAD, CHF, NZD, SGD, THB, DKK, NOK, SEK, ZAR, AED, PHP, INR, BHD, CZK, KWD, MXN, SAR, KRW) via Business Internet Banking or HSBC Business Express mobile app with a minimum transaction amount of USD4 or equivalent. In addition to these 25 currencies, HSBCnet also supports PLN with no minimum transaction amount required.

^This service will not be available during system maintenance.

Risk Disclosure

Currency conversion risk - the value of your foreign currency and RMB deposit will be subject to the risk of exchange rate fluctuation. If you choose to convert your foreign currency and RMB deposit to other currencies at an exchange rate that is less favourable than the exchange rate in which you made your original conversion to that foreign currency and RMB, you may suffer loss in principal.

Reminder: "To borrow or not to borrow? Borrow only if you can repay!"

Relevant T&Cs apply

Important information:

HSBC TradePay is available in selected sites and depends on a credit check and approval in advance.

HSBC reserves the right to request documents.

Payments will involve processing time.

Pre-approved finance allows you to trade with confidence.

3 https://www.hsbc.com/news-and-views/views/asia-the-middle-east-and-the-global-economy-in-2025

4 https://www.gbm.hsbc.com/en-gb/products-and-solutions/global-trade-solutions

5 HSBC TradePay is available in selected locations and is overed subject to credit checks and approval.

6 Payments do require processing time.